Key Takeaways

It is imperative that nonprofit leaders and policymakers track the economic and financial condition of the nonprofit sector — on its own and in comparison to other sectors of the economy — to have a complete understanding of how nonprofits are faring and what steps need to be taken to strengthen the sector.

Nonprofit finances are currently being crunched from several directions: In addition to the perennial struggle to balance budget and mission, nonprofits are facing increased costs of operations, disruptions to their government funding, and looming cuts to federal safety net programs that are likely to further increase demand for services.

“Nonprofits are looking at any and all solutions as it relates to meeting this moment financially. We know we’re going to get through it, but we want to be as adaptive as possible so we can meet the needs of the American people.”

The Nonprofit Sector’s Economic Contribution Is Substantial and Underestimated

The nonprofit sector contributes over 5% of the U.S. gross domestic product, or over $1.5 trillion in 2024 (U.S. Bureau of Economic Analysis, 2025b). Because the Bureau of Economic Analysis estimates the contributions of nonprofits by their expenditures — the people served by charitable nonprofits don’t pay for those services so the “value” can’t be estimated by price paid — this is a likely underestimate of the impact of nonprofits on communities. This is especially true during economic downturns and other crises, when the nonprofit sector may play a stabilizing role.

Despite the important role of the sector in the economy, these data and others (see Workforce section) are not always as accurate and timely for the nonprofit sector as for other sectors. Accurately assessing, measuring, and communicating the broader impact of nonprofit organizations is necessary for the sector to advocate for itself and the people we serve, but doing so remains a challenge.

In 2024, the nonprofit sector grew slightly more slowly (2.6% over 2023) than business (3.0%) or the economy as a whole (2.8%; U.S. Bureau of Economic Analysis, 2025a). Health nonprofits had a faster growth rate in gross outputs than most nonprofit industries, see Figure 2 (U.S. Bureau of Economic Analysis, 2025c).

Nonprofits Rely on Varied Funding Streams Beyond Individual Donations

The charitable sector relies on a variety of funding streams: individual donations, foundation grants, corporate donations and grants, and government contracts and grants, as well as program revenue, dues, and other income sources. In 2022, nearly one-third of the average nonprofit’s revenue came from individual donations, with foundation and corporate grants, government funding, and program revenue making up most of the remainder (Faulk et al., 2023). In 2024, the typical nonprofit received half of its funding from private sources (including individual donations, foundation grants, and corporate funds), 28% from government sources, 18% from earned revenue, and 4% from other sources (Figure 3; Tomasko et al., 2025).

Different types of nonprofit organizations have different funding models. In Nonprofit Finance Fund’s State of the Nonprofit Sector Survey, nearly nine in ten nonprofit organizations (88%) say they receive individual donations, but only a bit more than a third (35%) say individual donations are one of their two largest revenue sources (Nonprofit Finance Fund, 2025). Individual giving — from both small and large donors — is important for the sector, but by no means the whole story. Two in five organizations (41%) responding to the survey say foundation grants are a top funding source, and many organizations identify government grants (federal, state, or local) as top revenue sources. Though most nonprofit organizations (62%) report corporate donations, few (13%) say corporate donations are a top funding source.

Many Nonprofit Organizations Are on the Financial Edge

The 2025 National Survey of Nonprofit Trends and Impacts, conducted by Urban Institute in collaboration with George Mason University and American University, found that more than half (55%) of nonprofit leaders said their organization’s financial health was their biggest concern (Fallon et al., 2025). In their 2025 survey, Nonprofit Finance Fund (NFF) found that 81% of organizations struggled to raise enough funds to cover all of their costs, and 36% ended their most recent fiscal year with an operating deficit (Nonprofit Finance Fund, 2025). Best practice guidance recommends that nonprofits maintain three months of cash on hand (The Nonprofit Operating Reserves Initiative Workgroup, 2008). However, approximately one-third (32%) of organizations responding to the survey report having less than three months of cash available (see Figure 5).

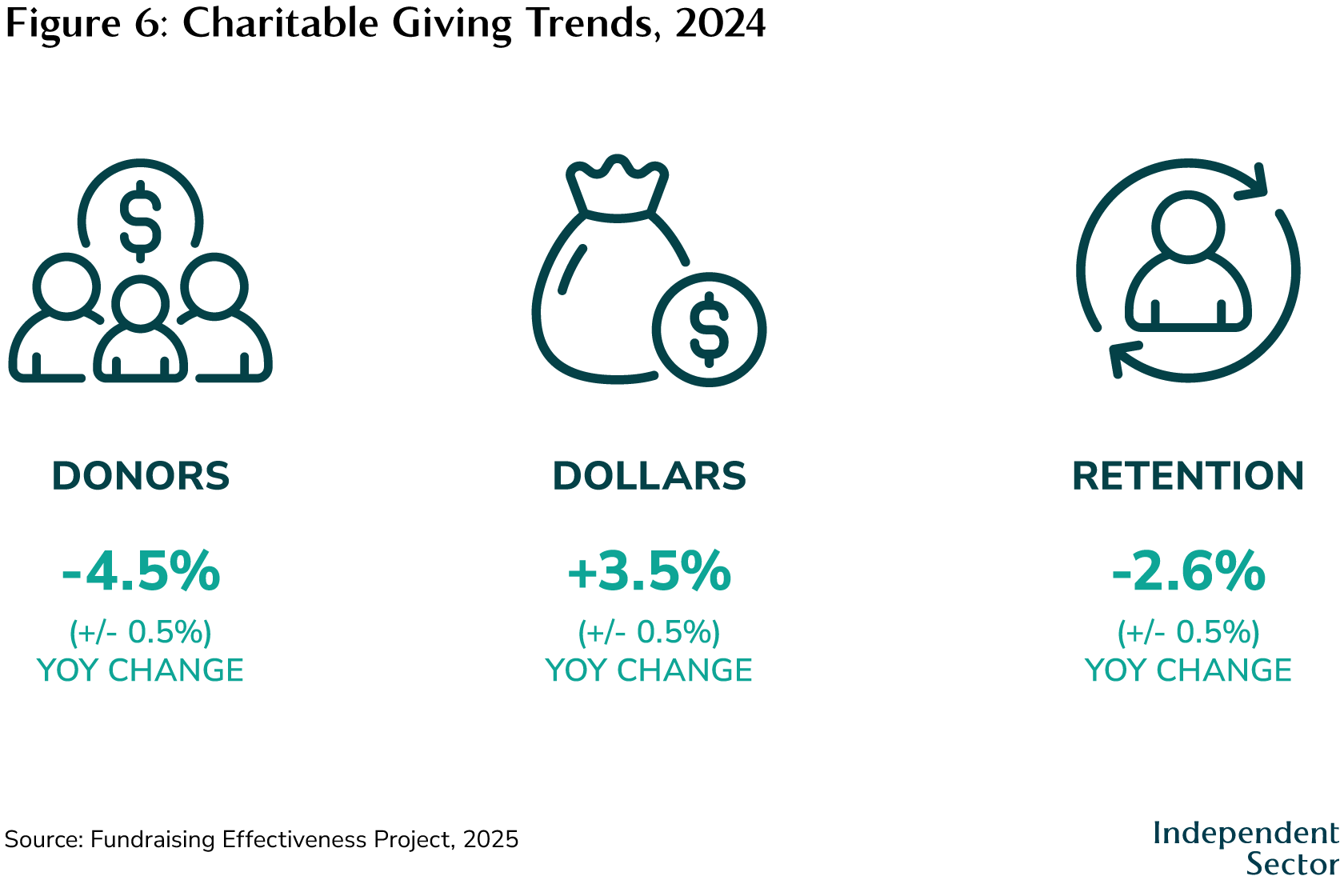

Charitable Giving Dollars Were Up and Donors Were Down in 2024

Total charitable giving in the U.S. — including individual, corporate, foundation, and bequest giving — reached an all-time high of $592 billion in 2024, though that total remains below the all-time high in 2021 in inflation-adjusted dollars (Giving USA, 2025).

The Fundraising Effectiveness Project estimates that in 2024, overall giving in dollars from individual donors increased by 3.5% relative to 2023, reversing the trend in the previous year. However, the number of donors and donor retention continued downward in line with the trend since 2021 (Fundraising Effectiveness Project, 2025). These 2024 numbers reflect an increase in large gifts (a 3% increase in those giving $50,000 or more) and a substantial decrease in the smallest gifts (a 9% decrease in donors giving less than $100). Though the increase in dollars is a positive sign for a sector where many nonprofits rely on individual gifts, the continued decrease in the number of donors suggests weakening connections to nonprofits.

Fewer donors is a concerning signal for the ability of nonprofits to build and activate their networks, as monetary giving is strongly associated with other forms of charitable involvement such as volunteering.

Government Funding Is at Risk

The so-called Department of Government Efficiency (not a department of the U.S. government) disrupted government agencies and programs in 2025. These disruptions included halts or rescissions of funding streams as well as layoffs and personnel changes at government agencies with which many nonprofit organizations coordinate. The administration has also threatened other streams of funding critical for many nonprofit organizations.

Internal Revenue Service data on government funding for nonprofits — including both contracts and grants — have been insufficient to create a comprehensive picture of the flow of funding to the nonprofit sector, making it difficult to craft a correspondingly complete picture of the possible damage to nonprofit finances and operations from these funding disruptions.

However, nationally representative survey data show that two-thirds of nonprofit organizations report receiving some kind of government grant or contract, inclusive of local, state, and federal funds (Martin et al., 2025). Over one third (37%) of nonprofits specifically reported receiving federal government funding* in 2024, and one third (33%) of nonprofits reported experiencing disruptions to government funding in the first 4-6 months of 2025 (Tomasko et al., 2025). Government grants to nonprofits flow to every state, every congressional district, and 95% of U.S. counties; of the more than 100,000 nonprofits reporting government grants on their IRS form 990, two-thirds would be operating at a deficit without their reported grants (Tomasko, 2025). (See Workforce and Public Policy & Advocacy sections for more on effects on the nonprofit workforce and the impacts of other policy changes.)

*Federal government funding includes federal grants, contracts or fee-for-service payments other than Medicare/Medicaid, and loans.

Costs of and Demand for Nonprofit Services Are Increasing

These disruptions to nonprofit revenue streams are occurring even as nonprofits face additional costs and demand for their services. Increasing operational costs were a prominent theme in Independent Sector’s CEO listening tour, and that theme is corroborated by data from Nonprofit Finance Fund’s 2025 State of the Nonprofit Sector Survey. When asked about the anticipated impact of current events and policy changes, more nonprofits (86%) said they were being impacted by higher costs driven by inflation than identified any other issue or current event.

In addition to higher costs of operation, most nonprofit organizations believe demand for their services is increasing, though they may not be able to meet that demand with the resources on hand. Most respondents (68%) to the Urban Institute’s 2025 National Survey of Nonprofit Trends and Impacts reported they expect demand for their organization’s services to increase over the next year, but just 31% said they have been expanding how many people they are serving this year (Urban Institute, 2025b). The survey was fielded before passage of a bill that will significantly reduce access to Medicaid, Medicare, and Supplemental Nutrition Assistance Program (SNAP) benefits for millions of Americans (see Public Policy & Advocacy section), suggesting that demand for services may increase beyond even what nonprofit organizations were already anticipating.

Take Action

A major concern for charitable giving over the next few years is the impact of changes to U.S. tax law as a result of this year’s budget reconciliation law—often referred to as the One Big Beautiful Bill (OBBB). While there are some positive provisions, the overall impact of the legislation is projected to reduce giving from both corporations and high-income individuals.

Harmful changes include a new “floor” that effectively disallows a deduction for the first 1% of taxable income donated by a corporation. The law also limits the value of all itemized deductions (including the charitable deduction) for high-income households that account for a disproportionate amount of charitable donations.

These changes may reduce giving by billions of dollars (Independent Sector, 2025). Independent Sector and other national charitable sector organizations opposed these harmful provisions and will advocate for their elimination (Council on Foundations et al., 2025). Learn more about how to contact your legislators and urge them to fix the damaging impacts of the corporate giving floor (EY QUEST, 2025).